Revisiting the Use of Money as Cash Waqf Instrument:

A Study of Money Creation

Waqf, through the use of money in the form of gold and silver or cash waqf[1] was practiced by the Ottoman society since the early 15th century (Sevket Pamuk, 2000, Timur Kuran, 2010). The cash waqf was first found in Erdine in 1423 (Mandaville, 1979). By 1560, cash waqf has become the most dominant method of waqf compared to other more traditional waqf[2] method across the world of Ottoman region. However, the fall of Ottoman Empire in 1924 also marked the fall of cash waqf. The waqf institution suffered even further decay during its era of modernization which later saw its full demise in 1954 (Razali Othman & Rohayu Abdul Ghani, 2010).

The challenges faced in revitalizing existing waqf properties lead to the reemerging of cash waqf. Cash waqf has not only been well received by the mass, but it has also become an important source of financing for socio-economic development of current ummah. However, the application of cash waqf is no longer based on gold or silver money (Rinaldo Zulikasio, 2008). On the other hand, fiat money (money created not based on any intrinsic value, managed by legal tender[3] and the value determined by market forces, which will be explained later) has been utilized as the instrument for cash waqf today. The question is to what degree can fiat money which has no intrinsic value used as an instrument for cash waqf? Or, is it complies with the maqasid of waqf?

Based on the above scenario, this paper aims to examine and analyze possible parallel between the philosophy of fiat money and maqasid of waqf. The article begins by first discussing generally the history of cash waqf and the use of fiat money in cash waqf. The second section will discuss the maqasid of waqf. The third section will discuss the concepts, history and philosophy behind the creation of fiat money. Finding from the analysis of interview of 11 experts on the philosophy of fiat money is debated in section four. Finally, the section five will sum up the overall aims of the article, which is to prove that the use of fiat money as an instrument for cash waqf is not in line with the maqasid of waqf which is clearly based on al-Qur’an, al-Hadith and ijma’ ulama.

- MAQASID OF WAQF: FOUNDATION OF THE SYARIAT OF WAQF

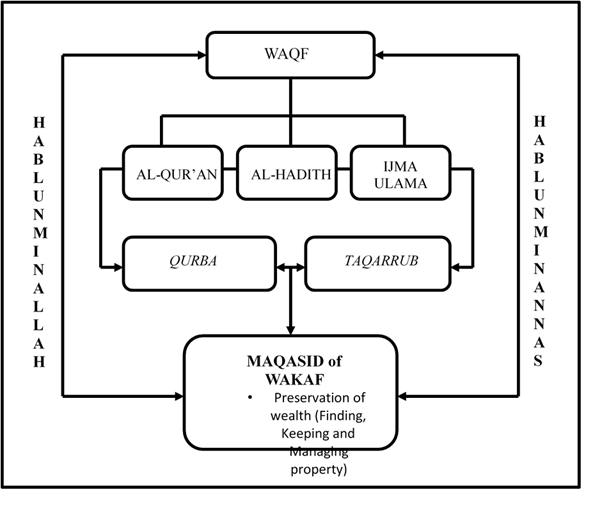

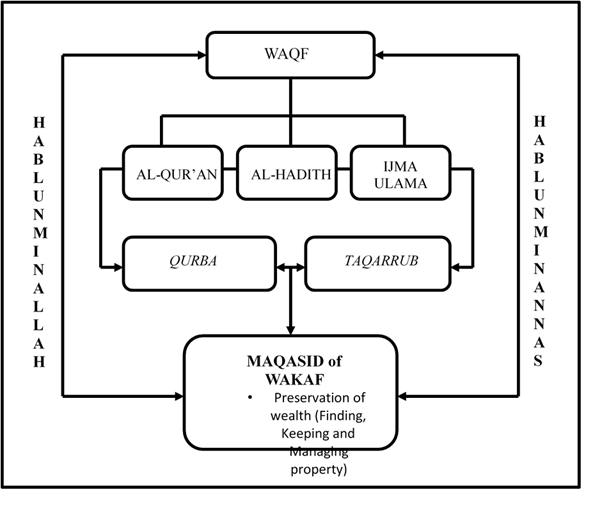

The debate on waqf revolves around the concept of conservation of properties (al-mal) which are considered one of the elements of darruriyah (Mohamad Akram Laldin et al., 2008). Cash waqf which is known as waqf an-nuqud is a waqf or trust fund created using money (Md. Shahedur Rahaman Chowdhury et al, 2011). In this context, money is also viewed as a form of property which needs to be preserved according to its intended goals in order to help mankind gain the blessing of Allah SWT (Habib Nazir & Muhammad Hasanuddin, 2004; Ahmed Algunduz, 2009). The studies by Magda Ismail Abdel Mohsin (2009) and Samiul Hasan (2011) shows that the maqasid of waqf is based on the syariat of waqf founded on al-Qur’an, al-Hadith and ijma ulama. According to them, doing good (qurba) with the intention to get closer to Allah SWT (taqarrub) is the reason that the person gives to cash waqf. The same has been clearly explained by Muhammad Abu Zahrah (2007). Studies by Razali Othman (2011) and Suhrawardi Lubis (2012) has further emphasized by earlier research. According to Razali Othman (2011), the verses which bring the meaning “those who believe and performs charity[4]” is mentioned 37 times in al-Qur’an clearly proves the Muslims are encouraged to perform charitable acts to gain reward inthis world and the hereafter.

To achieve this, Islam provides guidelines for acheiving, spending and determining the responsibilities of a property owners. Every individual is encouraged to seek wealth in the right way through halal resourses, and then spend it in the best way without waste, deception and avoid usury or riba as laid out in al-Baqarah 2:168, an-Nisa, 4:58 dan al-Mulk 67:15. In spending the property and wealth, Allah SWT also reminds mankind to always be honest and trustworthy as explained in surah al-Ahzab 33:72. Allah SWT strongly prohibits and promises a painful punishment to those who hide and hoard the wealth as He decsribed in the story of the stinginess and negligence of Qarun and Tsa’labah bin Hathib Al-Ansari[5]. On the other hand, Suhrawardi Lubis (2012) posits the maqasid of waqf as doing good (al-khayr), charity (al-bir) “sustenance” and sadaqah (infaq). According to him, all four categories are deeds aimed towards giving away properties in the name of Allah SWT for the benefit of the Muslim ummah. These deeds are performed to gain reward both in this life and the hereafter (Mustafa al-Khin et al., 2011).

The above discussion clearly shows that the maqasid of waqf is to perform good things (qurba) and to get closer to Allah SWT (taqarrub) as shown in Illustrastion 1.1. In fulfilling both forms of relationship, one can fulfil one’s responsibilities as Allah SWT caliph in ensuring the hablunminnas dan hablunminallah are met.

Illustration 1.1: Maqasid of Waqf Based on Al-Qur’an, Al-Hadith dan Ijma Ulama

- CONCEPTS and DEFINITION of FIAT MONEY

Fiat money is defined as any form of money created without pegging it to gold, silver or anyting tangible and of value (Evan, 2009, Gwartney et al, 2011). Ahamed Kameel Mydin Meera (2002) and Muhammad Nasri Md Hussain (2008) elaborated further on the meaning of fiat money to include paper money, bank money, accountng money printed by government through bank reserve based on interest rate and binary bit memory. Both scholars emphasize further that the money is used in a multitude by business and non-business transactions today.

Compared to gold and silver, fiat money has no form of ayn, therefore fiat money is easily destroyed, unstable and can be reprinted without limit. Its value is determined by public demand, confidence and trust (Nuradli Ridzwan Shah Mohd Dali, 2009). Should the public lose confidence in the money, then the money is only a piece of paper witout value. Interestingly, according to McEachern (2009), fiat money is accepted when a government declares its value. Therefore, fiat money is money accepted and permitted for use as legal tender as loan payback and medium of exchange. In addition, Rais ‘Umar Ibrahim Vadillo (2008) explains that fiat money is only legal value based on societal obligation to accept the money as currency for the settlement of debt. Rais ‘Umar Ibrahim Vadillo (2008) further adds that legal tender enforced by government restricts the use of any items as mode of payment. Any refusal to the legal tender is considered a crime which would result in legal repercussion (Rais ‘Umar Ibrahim Vadillo, 2003; Rohimi Shapiee & Muhammad Anowar Zahid, 2010).

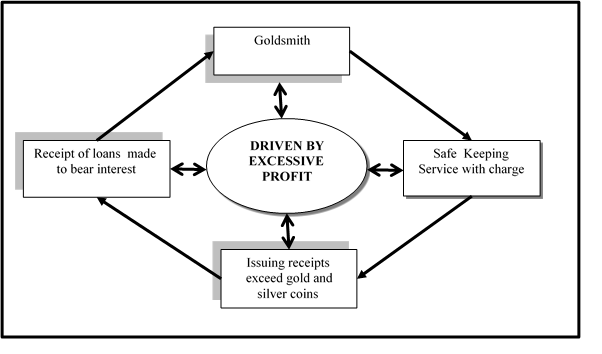

- History and Philosophy of the Creation of Fiat Money

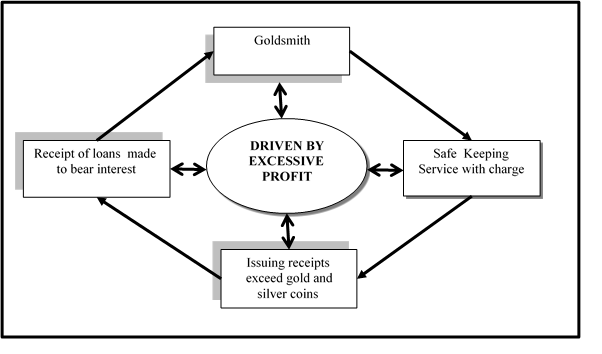

Fiat money[6] is considered one of the greatest creation in the history of money (Geoffrey, 1970; Lewis, 2007). Its use was triggered by the evolution of saving receipts issued by goldsmith[7] around 1500 (Murkherjee, 2002; Housel, 2008; Allen, 2009). Trading activities and daily transaction at the time were conducted using gold and silver. Since gold and silver are characteristically heavy, difficult to carry around in large amount, easily lost and or robbed, the goldsmith coined the idea to store them in their vaults. They usually received gold coins and valuables things from businessmen or the rich noblemen for safe keeping in these vaults. A certain fee was charged for the service given. This allowed the businessmen or noblemen to trade without having to be burdened by the weight of the large amount of coins gold and silver to carry around. At the same time, they no longer need to worry about possibly losing the gold and silver coins.

So, trading activities were able to take place easily and effectively. To prove that the gold and silver in their keeping are safe and secure, the goldsmith issued receipt bearing in information about the name of the depositer, total amount deposited and terms of the bearer to the depositer. They can withdraw all of their deposits whenever they wish to as long as they produce the receipt. According to Abdur Razzaq Lubis (1993) and Draughon (2006), the receipts were legal contract between the goldsmith and depositors. On the other hand, Rais ’Umar Ibrahim Vadillo (2006) and Tarek El Diwany (2010) described the receipt phenomenon as promising note or in short IOU (I Owe You). In other words, the receipts represent the amount of debt promised to be paid to the bearer.

The debt receipt in circulation then changed hands, and become a common practice widely accepted as a medium of exchange (Zuhaimy Ismail, 2003; Draughon, 2006). The goldsmiths’ receipt system then continued to be used and widely accepted as money. At the same time, the goldsmith started to realize that only the small portion of the amount of the gold in the vault was claimed by the depositors at any particular time (Heinberg, 2011). The greedy and profit driven goldsmith came out with the idea that they could produce more receipts than the gold and silver in vault by giving loans (Mukherjee, 2002; Rothbard, 2008). They then charged the debtors time-based interest rates (Berstein, 1965). As long as they were able to produce the amount of gold demanded by the borrowers, the goldsmith could then continue to increase the total amount of borrowings they give beyond the total amount of gold stored in their vaults (Sherman et al., 2008).

Activities of these goldsmiths raised three questions? Firstly, why are receipts that are only promissory notes between the goldsmiths and the borrowers which are not legally binding as legal tender is considered as money? Secondly, why weren’t those activities stopped and thirdly, why weren’t those goldsmiths charged for fraud or breach of trust? To answer the first question, scholars like Douthwaite (1999), Frost (2004), Draughon (2006), Sherman et al. (2008), Schlichter (2011) and De Soto (2012) in their studies concluded five reasons which explains the acceptance of the receipts as money. Firstly, the receipts were much easier to carry and to use. Secondly, the receipt based on gold coins. Thirdly, the gold was kept in a safe place. Fourthly, the confidence that the goldsmiths will be able to payback when claims are made. Finally, public acceptance of the receipt as money automatically gave it the global acceptance as money and medium of exchange. However, a study by Frost (2004) found that this system drive the goldsmiths to be greedy by producing more receipts to get more profits. On the other hand, Rothbard (2008) relates the system to the weakness of the legal tender at the time. Based on two classic cases[8], Rothbard (2008) claimed that the legal tender system at that time was not able to take action against the goldsmiths, and as such giving the goldsmith free reign in loaning money to the public. To reap bigger profits, the goldsmith had the idea to give loans through a method called Fractional Reserve Banking (FRB) (Skousen, 2010; Heinberg, 2011). The purpose is to rip people’s wealth for their personal gains in a cunning way. This method continues to be in play till today under the game called “banking”[9].

Scholars like Abdul Razzaq Lubis (1993), Rais ‘Umar Ibrahim Vadillo (2006), Imran Nazar Hosein (2007) dan Tareq El Diwany (2009), on the other hand critized the claims that fiat money represents debt. Rais ‘Umar Ibrahim Vadillo (2006) one of the most openly discuss the issue for example raised an interesting question, when paper money was a debt, was it acceptable? What issues concerning Islamic Law are relevant? In his previous studies, Rais ‘Umar Ibrahim Vadillo (2004) emphasizes that debt cannot be a medium of exchange as it may result in the transaction becoming haram. His arguments are based on the opinion of Imam Malik. In the kitab Al-Muwatta, Imam Malik expressed his viewed that,

“One should not buy a debt owned by a man whether present or absent, without the confirmation of the one who owes the debt, nor should one buy a debt owed by a dead person even if one knows what the deceased man has left. That is because to buy it is an uncertain transaction and one does not know whether the transaction will be completed or not.”

He also said,

“The explanation of what is disapproved of in buying a debt owed by someone absent or dead is that it is not known which unknown debtors may have claims on the dead person. If the dead person is liable for another debt, the price which the buyer gives on strength of the debt may become worthless.”

The general idea is that in order to transfer a debt the original issuer of the debt (the person who has the obligation) must guarantee the value of the debt to the transferee (the person receiving the note). Thus, the first contract is liquidated and a new private contract is created. Debt is always kept as a private contract between the parties. It does not circulate without the creation of a new private guarantee (a new contract). The reason is that the person who has issued the debt may have more obligations than he can fulfil. By relating the business scenario at al-Jar market, Imam Malik (2011) explained the hukum regarding the use of debt receipts as money;

“Yahya related to me from Malik that he had heard that receipts (sukukun) were given to people in the time of Marwan ibn al-Hakam for the produce of the market of al-Jar. People bought and sold the receipts among themselves before they took delivery of the goods. Zayd ibn Thabit, one of the Companions of the Messenger of Allah, may Allah bless him and grant him peace, went to Marwan ibn Hakam and said, ‘Marwan! Do you make usury Halal?’ He said, ‘I seek refuge with Allah! What is that?’ He said, ‘These receipts which people buy and sell before they take delivery of the goods.’ Marwan therefore sent guards to follow them and take them from people’s hands and return them to their owners.”

According to his records, it is clear that debt receipt has been in play since the time of Prophet Muhammad’s companion. He further added that the use of debt receipt had been banned as it contained elements of riba which are cruel and oppressive. Following on from the issuance of debt receipt by the goldsmiths lead to the creation of fiat money which is in use today as illustrated in Illustration 1.2. The philosophy behind it is clearly profit gained through a very cunning manner as discussed earlier.

Illustration 1.2: Fiat Money Creation Activities by Goldsmiths

PHILOSOPHY of FIAT MONEY: EXPERT ANALYSIS

PHILOSOPHY of FIAT MONEY: EXPERT ANALYSIS

Studies on the maqasid of waqf and the philosophy of fiat money debated earlier will be analyzed based on views on respondents collected through in-depth interview. The research methodology and finding will be explained in the following section.

This study is a qualitative exploratory[10] study as recommended by Creswell (2003) and David and Sutton (2004). Both primary and secondary data were utilized for the study. Primary data were collected through in-depth face-to-face interview. Semi-structured questions spread over one to one and a half hours interviews session proposed by Seidman (1998), DiCicco-Bloom and Crabtree (2006) and Wang et al. (2009) was applied in this study. The respondents are 11 experts selected through purposive sampling method and then categorised into three groups, namely Mufti, Academics and Practitioners. In addition two respondents were interviewed additional for a pilot study. Information gathered from the pilot study are analysed and included as part of the finding of this study.

All respondents were selected based on three factors. Firstly, the position held. Secondly, their extensive knowledge on waqf. Thirdly, the experiences in and exposure to this particular field. In particular, all selected respondents have served in their positions for more than 15 years. They also have extensive experience related to waqf and cash waqf, including direct involvement in leading an organization, plan, develop and implement activities related to the waqf, as a consultant at the organizational level or in the country, or giving lectures, writing and publishing books, proceedings and journals in various areas of waqf such as gazebos, economics, banking and finance. Some of the selected respondents have also previously headed research groups in studies on waqf institutions at organization or country levels. Human interactions have commonly been known to raise ethical issues in research as described by Wellington (2000) and Leedy and Ormrod (2005). Thus, three approaches have been taken, such as informed consent before and during interview and checklist for interview to ensure that all ethical issues such as harmony, sensitivity, perception, privacy and views of respondents are observed. Apart from that, the researcher employed multiple strategies to establish trustworthiness and to minimise the risk of avoidable errors in this study. These strategies consisted of audit member checking, peer debriefing, triangulation and pilot study. The validity and reliability of data are the two main criteria for determining the trustworthiness of a study, which is a priority in this study.

Data collected were analyzed using content analysis method which is one of the techniques of collection and analysis of information in textual form. ATLAS.ti software version 7.0 which is one of the Computer-based Qualitative Data Analysis Software (CAQDAS) will be used to help researchers determine the themes based on the research questions of information. For the purpose of discussion in this paper, all respondents will be named according to the coding system of PS001, PS002, AA001, AA002, AA003, PW001, PW002, PW003, KM001, KM002 and KM003. The nomenclature for the coding is done not only to protect the confidentiality of the information requested by the respondents, but also consistent with the account mentioned in the letter of authorization interviews with all the respondents concerned. The method of reporting will be done according to the following format. For example, the PS001 (2013:101). PS001 stands for quotations taken from respondents PS001. The figure represents the year 2013 that the interview was conducted in 2013. Meanwhile 101 figures is the number of rows that were taken in the text of the interview.

- Research Finding and Discussion

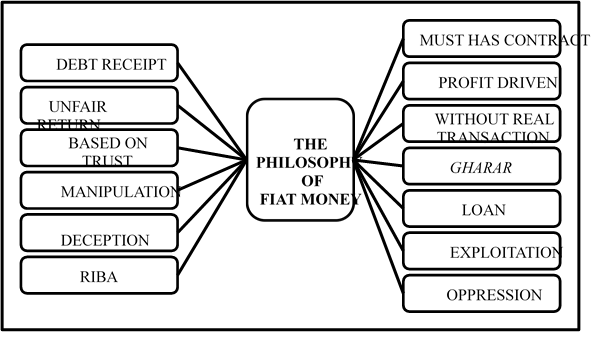

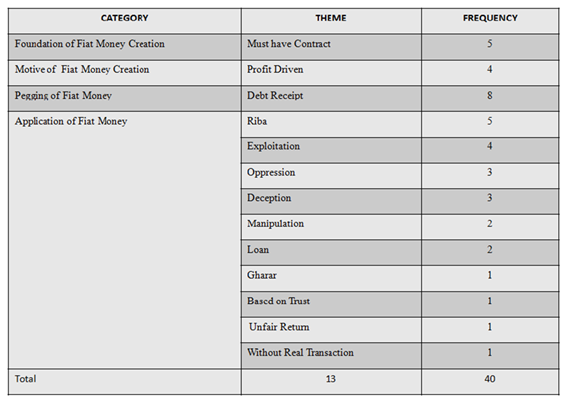

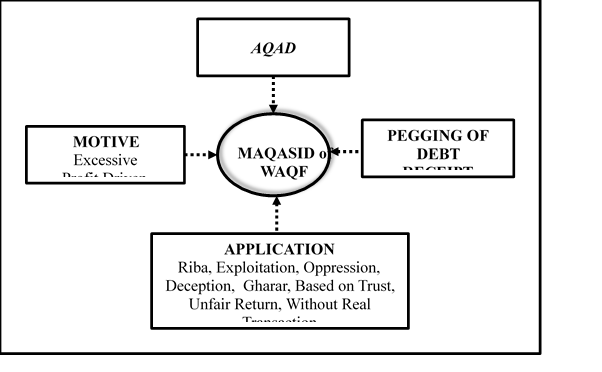

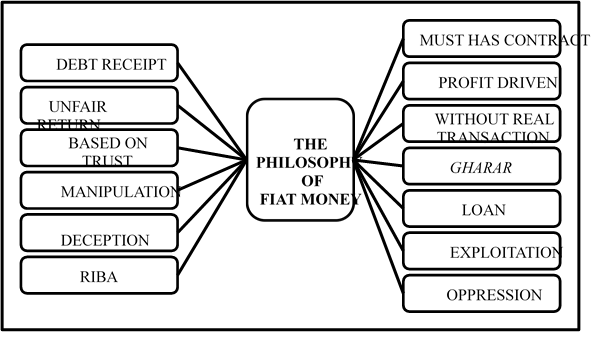

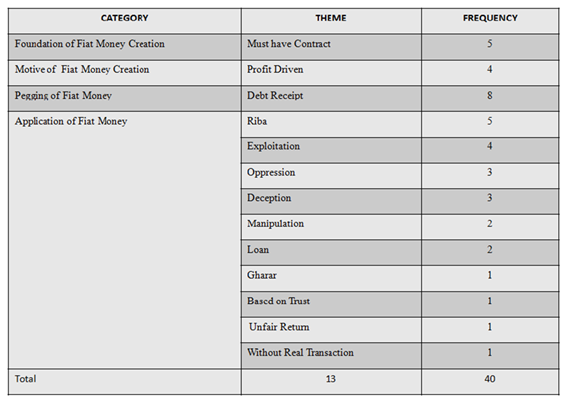

Interview information analyzed using ATLAS.ti produced 13 themes and 40 sub-themes related to the creation of fiat money as depicted in Illustration 1.3. Themes and sub-themes are clustered into three main categories as shown in Table 1.2. Firstly, the foundation of fiat money creation. Secondly, the motive for creating fiat money. Thirdly, pegging of fiat money and fourthly the application of fiat money.

Illustration 1.3: Respondents views on the Philosophy of Fiat Money

Source: Interviews with Respondents

Table 1.2: Fiat Money Philosophy Based Theme and Category Frequency

Source: Interviews with Respondents

The respondents were found to debate about the applications of fiat money in eight themes and 23 sub-themes. This produces the most themes and be the focus of discussions among the respondents. While the foundation of fiat money creation, motive and pegging fiat money of debt receipt, each has only one theme only. However, all of the themes and patterns of viewed amongst the experts in regards to the creation of fiat money which is used today as an instrument of cash waqf.

Basic Category of Fiat Money Creation

In debating the basic for fiat money creation, respondent AA001 (2013) appears to relate it to the demand for aqad according to the principle of fairness. He expressed his vied as the following.

"If the contract meets all the requirements (rukun), then it is valid. Because under the Shafie we observe what we see. Not the intention (niat). That is why the scholars of the Middle East will not allow Bitmai Ajil as it considered to be similar to riba” (AA001:2013:179).

In the above excerpt, he related aqad to the intention to enter into contract. He reiterated that an aqad needs to fulfil all its requirements, whilst the aspect of intention should be left for Allah SWT to decide. This view totally opposes the views of other scholars like Azila Ahmad Sarkawi (1998), Muhammad Nasri Md Husain et al. (1999:92-102) dan Sanep Ahmad & Shahida Shahimi (2005:548-552). According to these scholars, the non-parallelity between itention and requirement will lead to the termination of the contract sealed. This view is supported by respondent AA002 (2013:127) who also steressed the importance of itention and requirement of aqad. If not, parties involved will be considered to act in tyranny upon the owner of the money. On the other hand, the views expressed by KM002 (2013) and KM003 (2013) about the basic of money creation seem to link aqad in the creation of money through the concept of hiwalah. The situation is decribed as follows.

"It is already in Islam. We called it as Hiwalah. Transferring debt from A to B as B may be connected to A. In other words, it is harus. Suppose I owe A and A owe with Razali. So now I say A pays directly to Razali. But there needs to be a contract. There has to be an aqad to transfer the debt (KM002, 2013:226-229). "

"In fiqh, this is called Hiwalah. Meaning the transfer of debt, the responsibility to someone else. In other words, if I owe someone and someone else owe me. So, I can make a person who owes me to settle my debt to someone else. The debts are of similar value (KM003, 2013:95). "

What we can conclude from the above discussion is that aqad which fulfils the requirement of syara’ is pertinent, and also the foundation of money creation. The aqad performed must be aligned to the intention and the requirements of contract. Misalignment between the two will lead to the termination of the contract.

- Categories of Fiat Money Creation Motives

Four of the respondents interviewed concurs that the motive of fiat money creation is based on excessive profit-making principles (PS001, 2013; PW001, 2013; PW003, 2013; KM001, 2013). For example PW001 (2013:167) stated that profit made through interest rate is oppressive. PW003 (2013:129) on the other hand, linked profit motive to the principle of ethics. According to him, Islam permits profit-making, but prohibit profit made in multi-folds. Further, PS001 (2013) and KM001 (2013) expressed views that are more far-sighted, which encompass the argument made by other respondents earlier. Based on the philosophy of syariat of waqf and Islam, PS001 (2013) for example stated that;

"So if the link is made to the philosophy of the syariat of waqf, then we can see that there are two different philosophies. Waqf philosophy itself to get closer to Allah SWT and aimed at doing charity for the community. But, when this philosophy is established on the basic of reaping profit by exploiting what is for the community for personal gain, then I say this is definitely contradicts to the principles of Islam and goes against the principles of waqf(PS001, 2013:124). "

Although all respondents discussed earlier gave their views from differing perspectives, their views still all seem to arrive at the same conclusion. According to them, the motive of fiat money creation is deemed to gain profits through the unethical exploitation, oppression and burdening of others. All of which are criteria that go against the rules of syara’.

- The Category of Pegging Fiat Money to Debt Receipt

The respondents interviewed are found to be inclined to relate the philosophy of money creation to pegging of debt receipt. This is not surprising as the issue of the pegging of debt receipt has been the focus of various discussions amongst scholars as was described earlier. For example, Rais Umar Ibrahim Vadillo (2006:54) one of the scholars who is strongly advocating the debate expressed the following view:

“First paper money was issued by banks and it represented a certain amount of gold or silver, known as the specie. Even though it never was 100% backed by the specie, the issuing bank was obliged to pay the amount on demand. In this sense it represented a kind of debt (Rais Umar Ibrahim Vadillo, 2006:54)”.

In his earlier examination of the subject, Rais Umar Ibrahim Vadillo (2003) questioned the thursts pertinent to reaching the solution for issues regarding debt pegging to receipt, which are:

Who issues this currency? Is it a debt? If it is a debt, who has to pay for its convertibility? (Rais Umar Ibrahim Vadillo, 2003:698)”.

The question is, are the issues discussed by the sholars also raised by the respondents of this study. The answer is yes! In fact analysing of the responses by the participants in this study found two group of respondents who concurs that the philosophy of fiat money creation pegs on debt receipt. In reaching the final conclusion, both groups were found to focus their arguments on two matters. The first group is of the view that receipts pegged to debts are in line with the rules of syara’. However, the second group beleives that opposite. According to them receipts pegged to debt are against syara’. The view of the first group abaout receipts pegged to debt are expressed in the following arguments:

"If we look at how IOU is on one side. On the other side, I as a representative to you to keep the gold. The receipts is what I buy and sell. The pegging is the gold depositors (PS002, 2013:141)".

"If you are just giving IOU to the third party and the third party agrees Because the third party knows me and willing to accept that IOU, that's person willing to accept. May be something which cans be agreed upon (AA002, 2013:147-148). "

"Some views expressed the receipts as debt. The receipt is the sign of money owned. But the money is not there. Now we change it to currency form. If you previously used receipt. That is proof that you have money (KM001, 2013:139) ".

"I think the receipts or letter of pawn goes back to uruf. If it is certified, to be commercialized as a backup, it is not an offense (KM002, 2013:219-221).

Based on the notes above, the respondents gave four justifications to permit the use of receipts pegged to debt as the basis of fiat money creation. Firstly, debt receipt are pegged to gold (PS002, 2013). Secondly, public acceptance (AA002, 2013). Thirdly, savings in form of money in the bank (KM001, 2013) and fourthly, based on uruf KM002 (2013). However, in reality fiat money in circulation today is not pegged to gold. It is managed through Fractional Reserve Banking (FRB) requirement. Morever, the use of fiat money is made mandatory by the government through legal tendera and not optional as discusssed earlier. Based on this argument, the view of PS002 (2013), AA002 (2013) and KM001 (2013) are deemed weak and incomplete. The question is, can the issue of uruf become the basis to accept change as propossed by KM002 (2013)? In short, do Muslims today fully understand issues concerning the implications of the use of fiat money? Or, is it possible that Muslims use fiat money simply because others are using it, too? This question received the folowing interesting response from respondent KM002 (2013):

"It’s like this. The problem is related to familiarity or uruf. That is, supposing it be touted, uruf thing would have been customary in others. I believe that things can be done properly. So, to make the thing uruf, became widespread and the practice is time-consuming (KM002, 2013:192). "

He then continued to give an example of uruf in matters of muammalah, as follows:

"Just like us. If we are not used to eating eel, when forced to, we will eat it. If you really can’t eat you may just purge. So, getting used to it takes time. Just like money (KM002, 2013:196). "

The two quotes above highlight the fact that certain behaviours conducted according to principles of uruf can change when knowledge is revealed. On the other hand, the second group firmly asserts that fiat money pegged to debt receipt does not meet the requirements of Islamic syariah. According to them, receipt pegged to debt contains element of riba, has no equivalent value, and transacted on a debt to debt basis. Respondents PS001 (2013) explains his view by stating the following:

"When using the receipts for the purpose of gaining profit of adding value to the property, then in this case we discuss riba. If any transactions are based on the concept of riba, Islam forbids it. Riba clearly is form of oppression (PS001, 2013:124). "

On the other hand, repondents PW002 (2013:164) and KM003 (2013:101) emphasized the concept of debt based transaction to in parallel to the view of Imam Malik (2011) as previously discussed. This view seems to be forwarded in the effort to provide justifications for their view that the use of debt receipts goes against the maqasid of waqf.

- The Category of Application of Fiat Money

Ten issues which funnel towards the application of fiat money have been discussed (see Table 1.1). Riba transaction, exploitation, oppression, fraud, manipulation and loans are six elements focused on in the respondents’ discussion. Riba transactions are found to be more specifically emphasized by the respondents. Amongst the issues debated are concepts, implication and the relationship between riba and the Islamic syariat, as can be seen in the points they put forth, below:

"Definitely. If you are going to set the return amount based on how much money you put there, this is of course will be the RIBA (AA002, 2013:136). "

"If the creation of currency receipts is for the profits of selected parties such as the goldsmiths, then to me this is against the Islamic principles which prohibits oppression, especially in the context of the riba (PS001, 2013:125)."

"According to Islam it is not permissible riba, gharar. Just like fiat money. You can’t do wawf when thers is gharar or the sort (AA03, 2013:187). "

Based on the above quotes, return that are of pre-determined amount or excess monetary charge to someone are considered riba. Riba transaction are made to create profit by oppresing others. Thus, the practise of riba is haram, contradict the Islam syariat and should not be in practise (AA001, 2013:135; AA003, 2013:187; 2013:167). Furthermore, the application of fiat money is also said to inherently contain elements of exploitation, oppression, deception and manipulation (AA003, 2013; PW001, 2013; PW002, 2013; PW002, 2013; KM002, 2013). The four elements are deemed inter-related which may lead to a person taking advantage of the weakness of others through tyranic conduct or abuse of power. According to respondent AA003 (2013) this happens because fiat money in use today is not pegged to any intrinsic value. Hence this opportunity to exploited by the goldsmiths or banks to reap excessive profit that are totally one-sided, as described by respondents AA003 (2013) dan PW002 (2013), below:

" The goldsmith took advantage, just like the Bankers. It is just like you get them to store your gold for you, and they take a little-bit of it at time. The bigger bulk they keep for themselves, the ones they take are used and may change hands. I think this is the basis for the use of money now (AA003, 2013:135). "

"Should everyone who deposited make full claims on their gold from the goldsmith, they wont have the gold to give back. Hence, this is fraud (PW002, 2013:155-156). "

Those behaviour certainly not adhere to Islamic requirements as expressed by respondents KM001 (2013:140) and KM002 (2013:206). This study also found that the elements of gharar, based on trust, unfair distribution of returns and failure to create the actual transaction were debated by the respondent AA003 (2013:187), PS002 (2013:144), AA002 (2013:127) and PS002 (2013:130). Although these elements did not receive much emphasis from the respondents in the discussion, but the elements are considered to further strengthen the points made by previous respondents in regards to the application which contradicts the philosophy of waqf and Islamic syariat.

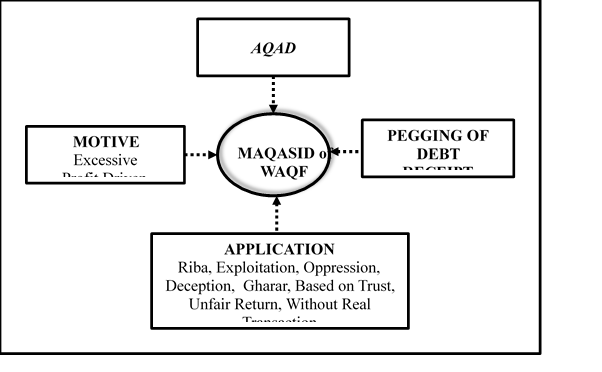

In general, the analysis of interviews with eleven experts discussed here resulted in the generation of four research outcomes in regards to the philosophy of fiat money and its relation to maqasid of waqf, as shown in Illustration 1.4. Firstly, the motive for the creation of fiat money is to reap excessive profit, which are exploitative, oppressive, unethical and a burdensome in nature. Secondly, although all respondents concur that the philosophy philosophy of fiat money is backed by debt receipts, these views however differ in regards to the Islamic rule about such receipt. Whilst one group of respondents views fiat money receipt pegged to debt is in line with the syariah law, the other group holds to an opposite view. However, the view held by the second group appears more firm based on the justifications they gave. Thirdly, the application of fiat money has inherent elements of manipulation, exploitation, oppression, fraud, loan based on riba, gharar, based on trust, unfair distribution of returns and failure to create real transaction, all clearly ignore the true meaning of maqasid of waqf. Fourthly, the requirements for there to be contract or aqad in determining validity of money creation philosophy. To this resercher’s knowledge this issue has never been disccussed by any scholars. Therefore, this is consider a novel finding which demands attention and further discussion.

Illustration 1.4: The Relationship Between the Philosophy of Fiat Money and Maqasid of Waqf

Source: Interviews with Respondents

In conclusion, fiat money which is not based on any intrinsic value has come into existance through debt receipt loan activities of the goldsmith. The excessive profit which is sits at the core of system inherently permit fraud, explotation, oppression, loan based on riba and gharar. Therefore it is clear that the philosophy which underlies the creation of money goes against the maqasid of waqf, which emphasizes the performing of good deeds for the benefit of others in order to gey oneself closer to Allah SWT. Hence, its use as an instrument for cash waqf will certainly contradict both the maqasid of waqf and the guidelines stipulated by syara’. Thus this study propose that the use of money as an instrument for cash waqf be relooked to ensure that the practice is blessed by Allah SWT.

Prepared by,

Dr. Razali b. Othman

Pengarah

Pusat Pengurusan Wakaf, Zakat dan Endowmen (WAZAN)

Universiti Putra Malaysia (UPM)

Email: razaliupm@upm.edu.my

[1] Differences of opinion about the origin of the creation of cash waqf has been debated by scholars like Leeuwen (1999:110), Gerber (1999:119), Murat Cizakca (2002:27), the Directorate of Zakat and Waqf Development (2004:9-11), Fitzgerald (2008:244), Hania abou al-Shamat (2008:162-163), Afizar Amir et. al., (2011).

[2] Traditional wakaf is a wakaf practice using fixed assets or immovable property such as land and buildings. See Murat Cizakca (2011:81).

[3] "Legal tender" is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation. See Roelker & Meyer (1863: 2-6) and Thayer (1887:7).

[4] The verses which bring the meaning “those who believe and performs charit” is stated in Surah Maryam 19:21, al-Anbiya’21: 94, al-Hajj 22:14, 22, 23, 50 and 56, al-Shu’ara’26:227, al-Ankabut 29:7 and 57, al-Rum 30:15 and 45, Luqman 31:7, al-Sajdah 32:19, Saba’34: 4, Fatir 35:7, Sad 38:24 and 28, al-Mu’min 40:58, Fussilat 41:8, al-Syura 42:22, 23 and 26, al-Jaathiyah 45:21 and 30, Muhammad 47:2, and 12, al-Fath 48:29, al-Talaaq 65:11, al-Inshiqaq 84:25, al-Buruj 85:11, al-Tin 95:6, al-Bayyinah 98:7 and al-Asr 103:3.

[5] See surah al-Qasas 28:76-84 and At-Taubah 9:75.

[6] The Szechuan province in northern China is reported to be the first region in the world to use paper from savings certificates known as feiqian or flying money. See Yang (1952:51-53), Abu-Lughod (1989:332-335), Hughes (2002: 41-43), Cheng (2003:10-14), Bernholz (2003:52-61), Rothbard (2008:56) and Schlichter (2011:13-14).

[7] Goldsmith is the oldest member of the merchant or City Hall English (aldermen). Typically, they have a huge capital lent to the King or other merchants. They also made ​​up of workers with high skills in making gold. See Gilbody (1988:12), Bailey & Law (2006:43), Draughon (2006:29) and Skousen (2010:15-16).

[8] The first case involves Carr v. Carr that took place in 1811. Judge Sir William Grant has given his argument that since the money saved is not isolated in a locked bag (sealed bag), then the money is considered a loan and not a guarantee (bailment). While in the second case of Foley v. Hill and Others case in 1848. Lord Cottenham, the judge has decided that the consumer is just as creditor banks. Then, he said again, it is up to the bank to do anything with the money deposited by savers. If the Bank fails to meet its obligation they are only considered as legitimate insolvent rather than fraud or offenders. See Rothbard (2008:92-93).

[9] Fractional Reserve Banking (FRB) is a deposit money in the bank that is subject to a number of specific reserves. The bank can use the extra savings from the reserves to be given soft loans.

[10] Exploratory study referred to a study of which little or no information on studies done before. Therefore, an exploratory study is usually performed to construct, evaluate and learn in detail about the problem. See Sabitha Merican (2005: 30), Sekaran (2005: 119-121) and Babbie (2007:88).

Date of Input: 29/04/2019 | Updated: 29/04/2019 | m.jazmi

MEDIA SHARING

PHILOSOPHY of FIAT MONEY: EXPERT ANALYSIS

PHILOSOPHY of FIAT MONEY: EXPERT ANALYSIS

.png)